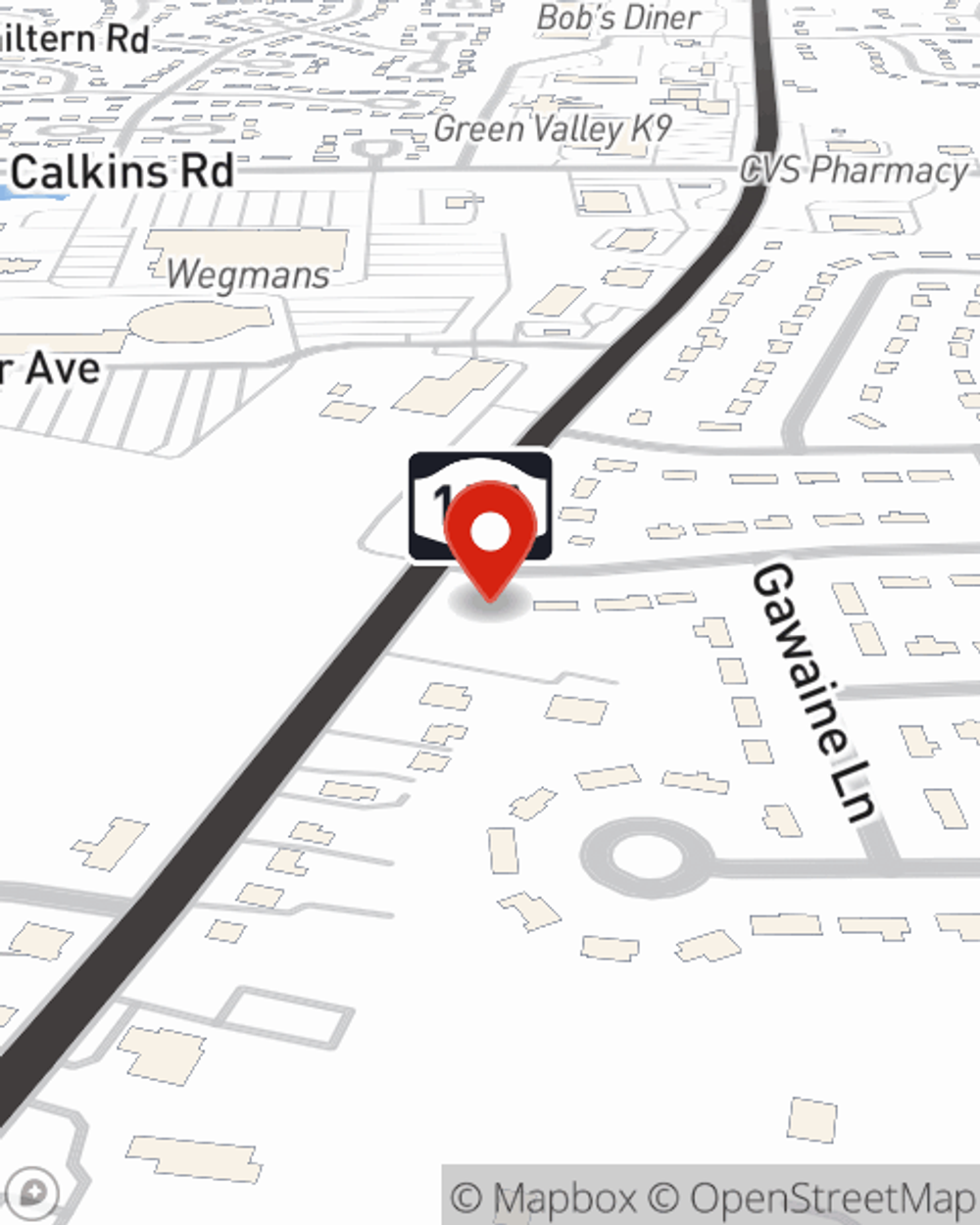

Business Insurance in and around Henrietta

Get your Henrietta business covered, right here!

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Operating your small business takes commitment, hard work, and outstanding insurance. That's why State Farm offers coverage options like business continuity plans, worker's compensation for your employees, errors and omissions liability, and more!

Get your Henrietta business covered, right here!

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

When you've put so much personal interest in a small business like yours, whether it's a veterinarian, a floor covering installer, or a HVAC company, having the right protection for you is important. As a business owner, as well, State Farm agent Ryan Sanz understands and is happy to offer customizable insurance options to fit what you need.

Call Ryan Sanz today, and let's get down to business.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Ryan Sanz

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.